Supply Chain

FINANCE

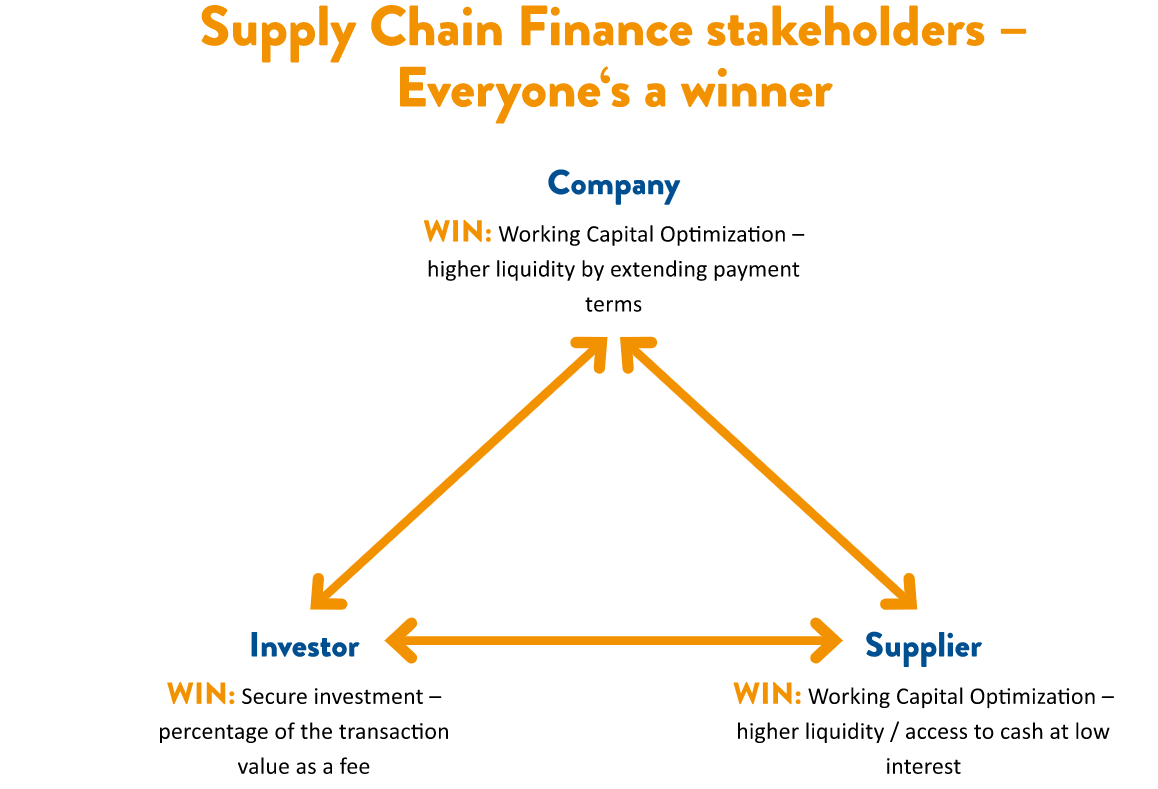

Everyone is a winner with supply chain finance

These uncertain times in the global market call for flexibility. But to be able to respond flexibly, it is essential to have large cash reserves available. Companies and their suppliers are coming to a head as they both seek to optimize their working capital. So, what’s the answer? Reverse factoring.

The German car industry was once the shining beacon of the stock market, and served as a role model for many other sectors. Thanks to superior engineering skills, the big corporations enjoyed fantastic growth, high profit margins, and expansion into more and more countries. Suppliers benefitted from the knowledge of experts in their field and gained loyal partners. One company’s ideas would fuel another’s, and vice versa. There was a time when an economic crisis in the sector was unfathomable.

But just a few years later, top managers at automotive manufacturers and suppliers started to become agitated. Companies have been rocked by the diesel crisis, the trade war is stepping up in the Asian and US export industries, Brexit is creating uncertainty in the European Union, and billions of dollars are needed to invest in innovations such as electro mobility.

Now, it is all about savings, leaner processes, and liquidity. Even in sectors with well developed supply chains and firm interdependencies between manufacturers and suppliers, nothing is possible without close cooperation based on mutual trust. This is true, not least for the automotive industry at the moment, but also for practically every sector – from the chemical and consumer goods industries to mechanical engineering.

Ultimately, it is about creating high cash reserves and low stock supplies. Investing smartly can work for companies and generate returns, despite the low interest rates. Liquid reserves are also needed for procuring at the right times, such as when the price of a raw material drops in the short term, therefore reducing risk and making procurement much more flexible.

Suppliers are also striving to create the highest possible cash reserves and optimize their working capital. Since the financial crisis, it has become increasingly difficult for SMEs to obtain a loan at an interest rate they can afford, as a result of new regulations for financial institutions, such as Basel III or the upcoming Basel IV, this makes issuing capital considerably more difficult.

Customers seeking to extend payment terms are causing more problems for suppliers. When payment is delayed, this negatively affects working capital, creating bottlenecks in liquidity and, in the worst case, bankruptcy. One of the most feared risks for customers

is non-delivery.

But financing solutions are available to help suppliers, companies, and investors alike: supply chain finance, or more precisely reverse factoring. It is intended to secure a company’s own liquidity as well as the strategic supplier’s. As the financial crisis came to an end, the new way of optimizing financial structures gained popularity for the first time . Supply chain finance has since become a firm favorite for many firms.

With reverse factoring, a company outsources its supplier’s receivables to an investor, which then assumes the interim financing for a fee that is lower than the refinancing rate.

For example, a supplier charges its customer, a mechanical engineering company called Techlife, €100,000 for 100 tons of steel. In order to work with the €100,000 for as long as possible, the customer seeks to secure a payment term of 90 days. Yet, the supplier needs the money as quickly as possible to replenish its stock of raw materials.

Instead of using its position of power and making the supplier wait for the money, the customer can arrange reverse factoring with the supplier. A fintech or a bank uses a platform that brings investors, suppliers, and customers together. The supplier now issues an invoice to its customer, which uploads it to the platform, functioning like a virtual marketplace. This has the advantage that several investors, mostly banks, are available for refinancing. They are now vying to pay the money to the supplier as quickly as possible for a fee, and in doing so they accept that the end customer will only pay the invoice to them much later. Using the platform

means companies operate independently from a single bank, which reduces the fee to be paid. It also massively reduces red tape for suppliers and customers.

In our example, the supplier Techlife submits the invoice, and asks an investor to pay it. Several investors bid to finance it on the marketplace, most for an interest rate just above the base rate, e.g. 1% per annum. The key factor is that Techlife is responsible for the entire transaction, as its creditworthiness is at stake, which suits the supplier very well; otherwise, it would have to pay 3% to 4% interest for the refinancing.

The 1% fee covers both bank and fintech platform fee, in this case €250. Either Techlife pays this fee by transferring only €99,750 to the supplier, or the supplier pays it directly to the investor. The investor pays the supplier the invoice amount after just a few days. The customer Techlife, on the other hand, does not pay the investor’s invoice until 90 days later.

In most cases, the fee is paid by the supplier. However, this is a negligible amount in the grand scheme of things, since the advantages of a higher working capital outweigh the fee. In the end, it’s a win-win for all parties involved.

A more diverse portfolio means more competition, which could mean better conditions.

It must be able to work with all your strategic suppliers.

The platform must connect to your own IT infrastructure as well as your strategically important suppliers’.

Implementation and ongoing processes should be supported by the fintech, including support for suppliers.

With reverse factoring, the supplier does not need to worry about an inability to pay or delayed payments. And thanks to the buyer’s solvency, it can benefit from a better interest rate. All in all, the financing costs can be reduced significantly. It also involves the supplier forging a close, mutually dependent relationship with the customer, which can offer a competitive advantage over other suppliers.

As the customer, Techlife can also use its working capital sensibly over a long period, and does not need to worry about the supplier failing to deliver, thereby increasing stability in its supply chain and reducing delivery bottlenecks.

Banks and investors receive a fee for the financing on top of the base interest rate; the profit is the corresponding difference. This is a particularly attractive option in these times of low interest rates, as the interest can be passed on to other buyers.

Reverse factoring is not suitable for everyone, though. If customers and suppliers have access to very high cash reserves, then refinancing invoices just does not make sense. Although reverse factoring is perhaps the most crucial method in an uncertain environment for procurement at the moment, it is very rarely used, comparatively speaking. In most cases, this is because of the high amount of coordination required, and due to a lack of specialist expertise, not least the cooperation needed with external experts who support the team for months during the long process restructuring.

With reverse factoring, the supplier does not need to worry about an inability to pay or delayed payments. And thanks to the buyer’s solvency, it can benefit from a better interest rate.

1. Get your departments on board

The department primarily responsible for supply chain finance is, naturally, the finance department. But to ensure the process is successful, this requires cooperation with other departments, such as accounting and legal. This is what makes supply chain finance so complex within a company. The procurement department’s close involvement early on and a clear division of roles, with the support of management, are especially crucial for success. The procurement department coordinates with suppliers, while the finance department takes care of the conditions and the financial benefits. Procurement is accustomed to working in cross-departmental teams, and as a networker within the company, is able to move the subject forward. Since it is this department that has the closest relationship with suppliers, it is this department that plays a key role in the process. Reverse factoring can only work if the suppliers are closely involved too.

The department primarily responsible for supply chain finance is, naturally, the finance department. But to ensure the process is successful, this requires cooperation with other departments, such as accounting and legal. This is what makes supply chain finance so complex within a company. The procurement department’s close involvement early on and a clear division of roles, with the support of management, are especially crucial for success. The procurement department coordinates with suppliers, while the finance department takes care of the conditions and the financial benefits. Procurement is accustomed to working in cross-departmental teams, and as a networker within the company, is able to move the subject forward. Since it is this department that has the closest relationship with suppliers, it is this department that plays a key role in the process. Reverse factoring can only work if the suppliers are closely involved too.

2. Choose the platform

The next step is to decide which platform should be used to broker the reverse factoring. In theory, the financing could go through a single bank, but the conditions offered would not be as good as on a platform where several investors are competing against each other. When choosing the platform, it is essential to determine whether the IT system is compatible with the customer’s. Is there a seamless connection via SAP, for example? In addition, the project team should check out the platform’s references to see which banks it has as partners, what experience others have had with it, and how global the platform is. Whether the platform also works with suppliers from the USA or China is something that could be particularly relevant to global companies. Platform costs are usually negligible, and do not vary much, so this should have little bearing on the decision.

The next step is to decide which platform should be used to broker the reverse factoring. In theory, the financing could go through a single bank, but the conditions offered would not be as good as on a platform where several investors are competing against each other. When choosing the platform, it is essential to determine whether the IT system is compatible with the customer’s. Is there a seamless connection via SAP, for example? In addition, the project team should check out the platform’s references to see which banks it has as partners, what experience others have had with it, and how global the platform is. Whether the platform also works with suppliers from the USA or China is something that could be particularly relevant to global companies. Platform costs are usually negligible, and do not vary much, so this should have little bearing on the decision.

3. Select your suppliers

Procurement now needs to start getting in touch with suppliers. Before turning all the tried-and-tested processes on their head, it is worth first selecting a small group of suppliers to take part in a pilot. Ideally, these will be strategically important partners that have been supplying the company for a while, with whom there is already a suitable relationship of trust. Procurement must approach these suppliers systematically, and provide them with as much information as possible. A test phase is then agreed, during which both parties can familiarize themselves with the methodology and the platform, without being directly bound by an agreement. Each one of these tests initially runs as a single project, tailored to each individual supplier, and is only later summarized in an all-encompassing process. If these initial tests with suppliers are successful, additional suppliers can be contacted and incorporated. As more and more experience is gained, processes can be optimized on both sides.

Procurement now needs to start getting in touch with suppliers. Before turning all the tried-and-tested processes on their head, it is worth first selecting a small group of suppliers to take part in a pilot. Ideally, these will be strategically important partners that have been supplying the company for a while, with whom there is already a suitable relationship of trust. Procurement must approach these suppliers systematically, and provide them with as much information as possible. A test phase is then agreed, during which both parties can familiarize themselves with the methodology and the platform, without being directly bound by an agreement. Each one of these tests initially runs as a single project, tailored to each individual supplier, and is only later summarized in an all-encompassing process. If these initial tests with suppliers are successful, additional suppliers can be contacted and incorporated. As more and more experience is gained, processes can be optimized on both sides.

4. Clear the legal hurdles

To prevent legal or even accounting difficulties, involving the legal and financial departments is a must. The agreement needs to be based on trade accounts payable and not become a financial service, because then there is a reclassification risk. This means that the contracts have to be rewritten early on to include an extended payment term. Refinancing is then independent of the actual contract. The supplier joins the fintech platform, and is paid through that platform, but has no written guarantee that it will actually be paid any earlier. The deal and the many advantages that come with it are based on trust instead. So, it is important to involve your company’s own departments and suppliers in the planning as closely as possible.

To prevent legal or even accounting difficulties, involving the legal and financial departments is a must. The agreement needs to be based on trade accounts payable and not become a financial service, because then there is a reclassification risk. This means that the contracts have to be rewritten early on to include an extended payment term. Refinancing is then independent of the actual contract. The supplier joins the fintech platform, and is paid through that platform, but has no written guarantee that it will actually be paid any earlier. The deal and the many advantages that come with it are based on trust instead. So, it is important to involve your company’s own departments and suppliers in the planning as closely as possible.

5. Monitor the process

To make reverse factoring successful, it is important to clearly define the responsibilities and KPIs. Once all framework conditions have been agreed, the process is then managed by the finance department, but there must be rules on which issues involve procurement. After all, it is always the procurement department’s job to communicate with suppliers. If the first pilot projects are successful, it is up to procurement to build trust with new suppliers and convince them of the benefits of supply chain finance. Finally, feedback is routinely required from each supplier to help identify any potential for improvement in processing.

To make reverse factoring successful, it is important to clearly define the responsibilities and KPIs. Once all framework conditions have been agreed, the process is then managed by the finance department, but there must be rules on which issues involve procurement. After all, it is always the procurement department’s job to communicate with suppliers. If the first pilot projects are successful, it is up to procurement to build trust with new suppliers and convince them of the benefits of supply chain finance. Finally, feedback is routinely required from each supplier to help identify any potential for improvement in processing.

Many companies are apprehensive about optimizing their working capital. This is where financial service provider marketplace CRX Markets can help. CEO Frank H. Lutz discusses why working capital has become such an important topic and which sectors can take advantage of it.

Many companies are apprehensive about optimizing their working capital. This is where financial service provider marketplace CRX Markets can help. CEO Frank H. Lutz discusses why working capital has become such an important topic and which sectors can take advantage of it.

What do CRX Markets actually offer, Mr. Lutz?

We are a platform that facilitates working capital solutions. We work with companies looking for these solutions and banks offering financing. We receive a commission for our service, which depends on the amount financed. It is a very attractive proposition for companies, as they can see more quickly which provider provides the best conditions and can therefore reduce their administrative burden.

Companies understandably appreciate the improved transparency, butwere banks critical of this at first?

Yes, of course. They were rather skeptical at the start. What helped, though, was that we were soon able to get some major customers on board. These acted as pioneers for us, as they told their banks that they would only be able to conduct their business through our platform in future.

Since then, however, most banks have realized that they have to remain flexible in order to be fit for the future and also be open to new concepts such as our platform. We also offer added value, opening a door for many banks that previously had nothing to do with working capital financing. They can now move into new business areas, all thanks to us.

What kind of financing solutions do you offer specifically?

We offer an all-inclusive package that takes care of everything, with solutions for both the asset and liability sides of the balance sheet. A major area for us is factoring: both classic and reverse factoring, with third-party financing. There are also offers based on discounts, such as dynamic discounting in which customers leverage their own solvency on our marketplace.

Is it worthwhile?

Absolutely. Interest in optimizing working capital is constantly on the rise. It has slipped under many companies’ radars until now. I honestly don’t know why it has taken them so long to become interested. But admittedly, when I was a CFO at other leading companies, it was always a side-issue.

Why are so many companies suddenly showing interest in this area?

Working capital financing frees up assets for use in other investments. In other words, in order to remain competitive, companies have to drive forward innovations that typically involve large investments. There is hardly any sector where this would not be relevant. The automotive industry is switching to new types of drive, the chemical industry is changing, and food manufacturers are increasingly focusing on sustainability and fair working conditions. There is also a lot going on in retail as well, such as supermarkets having to work with new delivery methods.

Is working capital optimization particularly suitable for industries undergoing transformation?

Yes and no. It certainly does help those types of sectors, but even in more stable sectors, working capital optimization is a responsible form of risk management. When I was CFO at MAN during the financial crisis, our bank told us one day that it was no longer able to carry out any transactions. We had to write the checks out for our suppliers ourselves. The only reason we could do this was because we had the funds we needed, and our capital was not tied up elsewhere. Maybe we didn’t call it working capital financing back then, but it was what saved us.

Is crisis management the sole driver behind this?

Not at all. Corporate social responsibility also comes into it. We often view working capital purely through a financial lens. But you can also set other standards, such as fair working conditions with suppliers.

How can working capital financing help there?

As a customer, you could choose to offer your suppliers more attractive financing terms if their production methods are fairer, as we are seeing in the fashion industry.

Are there sectors you can see that are lagging behind?

I wouldn’t call it lagging behind, but there are of course areas where working capital is not that important. Government agencies are one example, but there has also been little interest in the health sector thus far.

So, there is good growth potential for CRX Markets?

Our growth does not just depend on gaining more and more customers. We also look at whether it is worth expanding our product portfolio. We built the platform as a marketplace, and now, in principle, we can offer almost anything through it. But of course, we always look at which products actually suit us.

Working capital optimization is not just a crisis management tool. It can also be used to make a company more competitive in the long term. Dr. Oliver Vogler, Managing Director for Western Europe at lighting manufacturer Ledvance, explains how.

Working capital optimization is nothing new of course, Dr. Vogler. But it is something that Ledvance has been focusing intensively on recently. Why is that?

The lighting business is a tough market. The transition from conventional technology to LED is shaking up every company. When we were spun off from Osram, 80% of our products were non-LED – now, just 25% are. Our LED light bulb suppliers are mainly located in China, which means long delivery routes. That, in turn, means capital is tied up for a long time. In order to remain profitable, we had to make some changes. We could work on increasing revenue and improving the profit margin, of course, but working capital is a very effective lever, particularly for a company like ours.

How so?

A core part of working capital optimization is mastering the product phase-in and phase-out over the life cycle, so you always have enough stock in the warehouse, without having too much. If you get it wrong, you will very quickly find yourself having to get rid of stock at marked-down prices. The main reason is that there are very short product cycles in the world of LED; many products, especially light bulbs, become obsolete after just a year, or even a few months. If we have a lot of models of a certain generation in stock, then we have to sell them at high discounts or, in the worst case, scrap them, which also costs money.

How do you avoid excess stock now?

Proper planning is very important. The ramp-up, i.e. the start-up phase, of a product must be launched early enough to give as much time as possible to sell a product before the next model comes out. Another important step was to change our corporate culture.

What was the problem there?

A large number of our sales managers were projecting too high quantities, because they were measured primarily by their sales figures, not by working capital indicators. It didn’t matter to them whether the light bulbs were sat in the warehouse or even had to be scrapped in the end, as long as they achieved their sales targets. I couldn’t really blame them. After all, like most companies, we were motivated by sales. Working capital optimization only works if the whole company is on board. Every single employee needs to keep track of the total cost of their decisions and we as management must clearly communicate the relevant KPIs and cash effects to everyone. Plus, we have to drill effective KPIs into everyone, and get rid of the old sales or growth-driven way of thinking.

But excess stock wasn’t the only reason why Ledvance needed to optimize its working capital, was it?

No, of course not. There were other factors. We had to close some of our factories and make severance payments, which reduced our cash flow.

Our product range during the transition from traditional to LED-based products was also too wide. But we have fine-tuned the range over the past year or two, and focused on the products that are profitable. We have also completely streamlined our supply chains. Our new owner helped us a great deal with that.

Since 2018, you have been part of the Chinese lighting group MLS…

Yes, and we have been through some major changes over the past few years. For a long time, we were part of Siemens, before being acquired by Osram in 2013. We then operated independently from 2016 onward, but now, we are part of MLS.

What major changes is the new owner bringing to your supply chain?

Firstly, there is a new geographical focus for us. More and more of our products are being manufactured in China, as production in Western Europe is on the decline. This is partly driven by the switch to LED technology, which is primarily manufactured in China, though of course this will also be optimized even further by our new owners. We increasingly rely on suppliers in China that can supply us with finished components; we then only assemble the lights. We are currently trying to bundle our suppliers, which is also where working capital comes in.

How so?

If we have just four suppliers instead of ten, we can give them more orders, which makes us a more valuable customer to them. That gives us more leverage in the negotiations, for example when it comes to negotiating prices or significantly extending our payment term and it’s worked. Sometimes, we have agreed on more than 100 days, which gives us more breathing space in our payment process.

Isn’t there a certain risk to that? What if one of your few suppliers stops trading or experiences problems on the long delivery routes to Europe?

We aren’t naive. The more we depend on individual companies, the more difficult a problem would be for us. For a company like ours, having a second source is essential for every component. That’s why we have a back-up plan for every product.

Our healthy working capital balance also comes in handy here. The more cash we have available and not in unused stock, the better we can cope with delivery problems.

So, ultimately, working capital is useful not only for responding to crises, but also as a means of prevention?

Definitely. That is one of the most important lessons we have learned in the transformation. A good working capital balance sheet makes any firm more resilient. That’s why the process is still ongoing: there are always new approaches to consider.