Aligning risk management to the framework of global supply chains

Capacity and supply bottlenecks are a problem for almost all of the participants in our latest risk management survey. The risk of rising prices for intermediate products and increasing energy costs are also impacting procurement departments. Businesses are hard at work putting out these fires. Long-term investments in “fire protection” seem to take a back seat.

In our annual study, we examine how risk management in procurement is set up in companies and which risks are currently impacting companies also with view to the German Supply Chain Act which came into force in January 2023.

Download the latest study results

What are the risks in procurement?

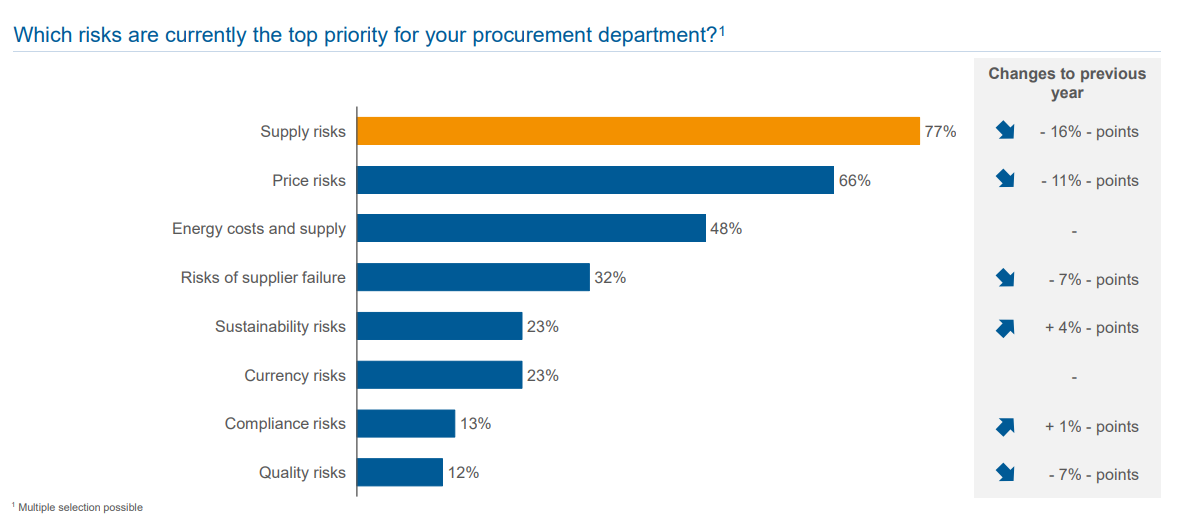

Risks in procurement include all potential events that may not go according to plan and can have a significant impact on pricing, security of supply or quality. For professional risk management, the risks in procurement should first be identified. The following risks are currently receiving greatest focus within procurement teams:

- supply risks

- price risks

- energy costs & supply

- supplier default risks

- sustainability risks

- currency risks

- compliance risks

- quality risks

Extract from the latest Risk Management Study:

Energy supply is a risk for most companies – they expect purchasing prices to continue to rise and increase cost pressure. For 83% of those surveyed, rising energy costs currently represent a business risk. Rising prices for raw materials and preliminary products are impacting 72%. At 66%, the risk emanating from supply bottlenecks has decreased slightly in importance compared to last year (-27 percentage points): Coronavirus-related supply uncertainties are declining, marking a slow return to the original material availability.

Rising purchase prices as a result of inflation are increasing the cost pressure for Procurement. 74% of the companies surveyed expect increased prices as an effect of inflation (top 1) and 70% see themselves exposed to increasing cost pressure in the future (top 2). 57% rate the influence on their own active risk management as (very) high; 26% expect (very) major effects on the product group structure. Around 20% of participants are expecting major impact from supplier insolvencies; 40% see little or no influence.